Offsetting mortgages

These mortgage loans let you use-money inside the connected informal membership so you’re able to effortlessly cure (offset) the quantity you continue to owe on your own home loan. That means you could end up expenses quicker interest and from your home mortgage with every regular installment. It does have a very powerful and ongoing effect. A knowledgeable means is to put your earnings with the offsetting account when, pay for your primary requests with a credit card after that repay that completely after new month. It has actually their offsetting balance all the way to possible and you can your own counterbalance home loan harmony lower so long as possible. As your financial interest percentage is calculated to the everyday balance, this has an effective impact.

Revolving credit mortgages

Revolving credit mortgage loans are just demanded whenever you are really controlled when considering dealing with money. They have been instance an extremely large overdraft having a drifting financial interest rate. It is possible to make payments (deposits) of any amount when you choose and you can acquire to this new arranged restrict if it provides. Particular enjoys a bringing down limitation keeping you focused. Treated better they can be such as for example a keen offsetting financial, but there is however a real danger of are tempted to remain borrowing up to the newest limit having non-very important commands.

- The flexibleness to boost the regular money otherwise repay lump figures in the place of punishment as soon as you like

- The possibility to attenuate the regular payments back to the desired minimum, if you’re paying more you need to

- Your quickly https://paydayloanalabama.com/vina/ work with if the rates of interest go lower

- The choice to evolve to help you a predetermined rate of interest financial at the at any time

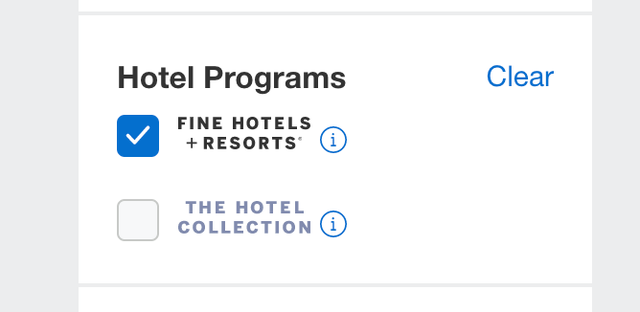

- Even more mortgage products to pick from, including offsetting and you will revolving credit mortgage loans

- You can option loan providers without having to pay a predetermined mortgage very early fees penalty towards the most recent one to

Which are the downsides out of a drifting mortgage?

- Drifting interest rates usually are greater than fixed rates, which means it will require stretched and value plenty more within the desire so you can at some point pay your home mortgage completely

- If the interest levels improve, their regular payments will instantaneously carry out the exact same; and though repaired interest rates also increase people costs create perhaps not changes until the stop of your fixed rate identity, which will be 10 years aside

Do you have more than just one type of home loan?

Sure. Many people do that to get the best of both planets. They split their property financing anywhere between a floating mortgage and you can good repaired mortgage. The floating home loan provides them with independence for extra money it assume and also make. The newest fixed speed home loan brings a beneficial level of cost management confidence and you will serenity-of-brain.

What is the greatest split up anywhere between drifting and you can repaired mortgages?

Some people make the floating region an enthusiastic offsetting financial to further eliminate attention costs. You may also favor one or more fixed rates mortgage. Insurance firms all of them towards some other fixed rate notice terminology, particularly a one year repaired and you can a three-year fixed, you reduce the threat of being required to re also-develop everything you whenever rates might be high.

An effective large financial company has got the experience in order to strongly recommend and define the best financial place-ups to suit your situation and you can upcoming wants. These are generally paid back by financial you choose to go which have, so there was always no additional charge for you. Our very own free Get a hold of an agent provider allows you for connecting that have among The new Zealand’s greatest mortgage advisers from our hands-chosen panel.

To learn more

- For lots more regarding other home loans discover all of our useful guide so you can sort of mortgage loans