You need more money yet not sure just how to unlock it? Having an enthusiastic FHA bucks-aside re-finance, you can access to 80% of the house’s worth and turn into the collateral on the cash.

Like other cash-aside fund, FHA cash-away refinancing works by taking out fully a much bigger financing than what you currently are obligated to pay to your domestic. You employ this to settle the current loan, next pocket the difference while the cash within closing.

Why does a FHA cash-away refinance functions?

FHA bucks-aside refinancing works by allowing home owners so you can re-finance their current financial for more than it owe immediately after which researching the difference because a lump sum payment of cash. This is great for whoever has established a critical quantity of collateral in their house.

closing costs, and therefore generally include 2% so you’re able to six% of your loan amount. Incase an average closure price of four%, the actual cash you can get will be the $40,000 potential cash-out without $one,600 in closing will set you back, leaving you that have a lump sum of about $38,eight hundred.

How to get an enthusiastic FHA cash-away re-finance

Are you leverage your own home’s equity for extra bucks? The newest FHA bucks-away re-finance may offer the fresh monetary liberty you might be trying to.

Regardless if you are an initial-time family client or a seasoned homeowner, here is what you can expect whenever applying for this type of loan.

The first step inside an FHA bucks-aside refi is to calculate your own readily available family guarantee, which is basically the market value of your home without one present mortgages or any other liens. In addition to collateral, loan providers might discover a reputable credit score and you will a great steady monthly earnings to be sure you can afford the newest home loan costs.

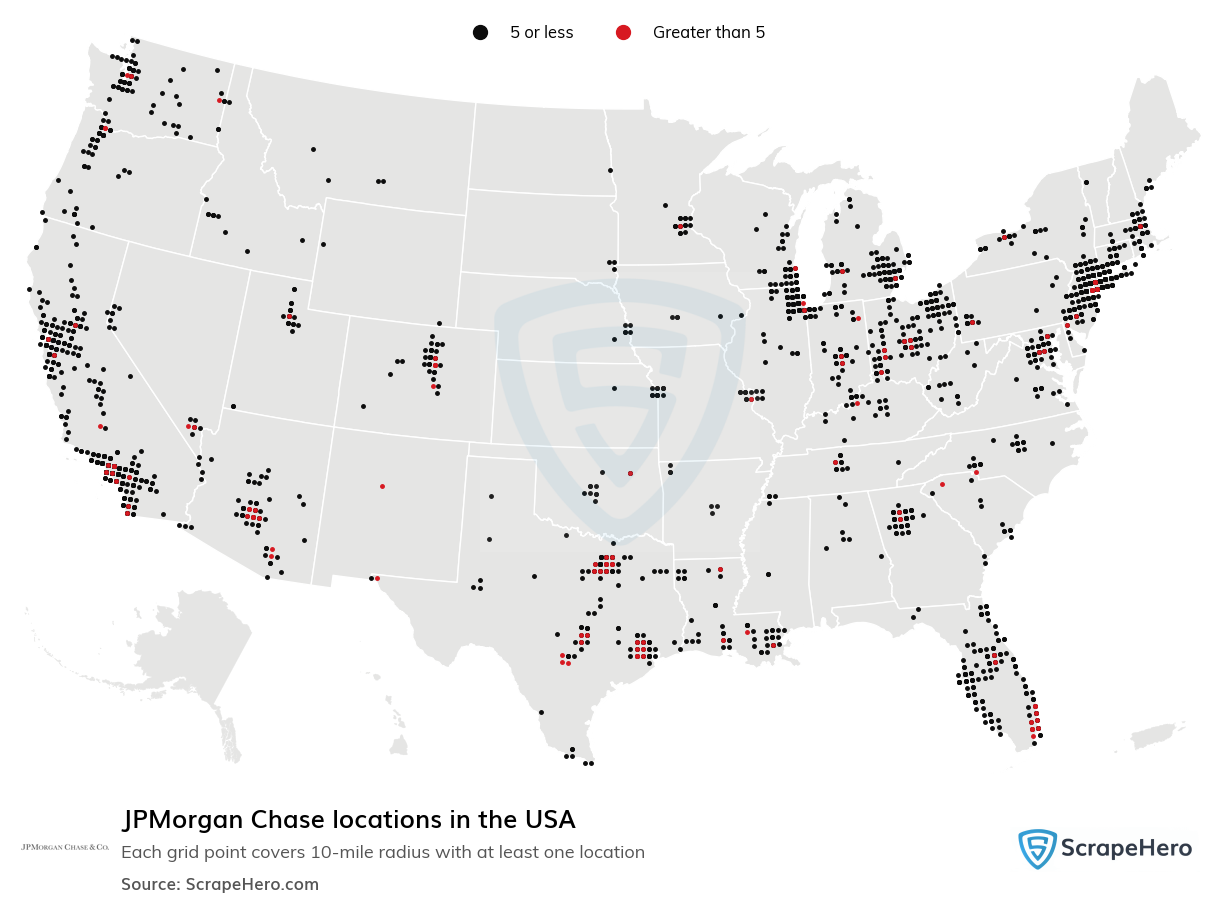

Step 2: Favor a keen FHA-recognized bank

Your upcoming circulate is to obtain a home loan company signed up to provide FHA financing. While the FHA assures this type of fund, they won’t in fact originate them. Very banks, credit unions, or other creditors give FHA finance, so you should has a lot of choice.

Action 12: Finish the software

In order to stop-initiate the latest FHA mortgage refinance processes, you’ll complete a Consistent Residential Loan application. Which application tend to consult guidance between your personal americash loans Beulah Valley facts-such as your title and you may Social Safety count-to your monetary information, such as your month-to-month money and established bills.

The lender will then pull credit file on the about three chief credit agencies: Experian, Equifax, and you can TransUnion. Your FICO get is likewise analyzed. Based on your unique items, you may need to provide more data. An assessment is likewise conducted to help you verify your own residence’s current market price.

Action four: Personal the mortgage

When the every happens well along with your application is recognized, you are able to improve to your closing phase of your own FHA refinance. And here you are able to sign the newest paperwork and you may target one remaining closing costs, that you have the choice to invest in into the loan. The fresh FHA-insured loan often alter your latest home loan. Observe that if this is your primary household, you’ll have an effective 12-big date period to reconsider your decision.

FHA bucks-aside re-finance requirements

Individuals making an application for a keen FHA dollars-away refinance need see criteria set by the Government Homes Management. Specific requirements may vary because of the financial, however, property owners usually need certainly to meet with the FHA’s minimal guidelines.

Yet not, FHA refinance costs are often more competitive than frequently occurring ones. Very for many home owners, financial insurance is a fair tradeoff for the money as well as good the fresh new, straight down rate.

The amount of money must i rating that have FHA dollars-aside refinancing?

You might obtain doing 80% of your home equity. Thus, the importance you’ve set in your property will ultimately influence the fresh restriction amount of money you can get using a keen FHA cash-away refinance.