It will be enjoyable and you can cheaper when deciding to take good sledgehammer so you can a wall your self, however, finding out pursuing the proven fact that it absolutely was lots-bearing wall surface will make you feel the latest comic save towards a home recovery show when you find yourself costing you a bundle.”

Investing in everything

Not even half (42%) out of property owners just who obtained home improvement strategies for the past 2 years state they are able to easily purchase the newest most of all of them in place of making use of offers, entering debt otherwise and work out sacrifices, with regards to the latest NerdWallet survey. Which is down off 52% who told you the exact same thing as soon as we questioned in the 2020.

But these systems will be high priced, and you may 20% off homeowners who took on including programs over the past a couple of ages needed to make sacrifices including lowering to the discretionary investing or promoting items, 14% must utilize or fatigue crisis savings, 12% must deal with obligations like financing otherwise bank card financial obligation, and you may 8% lent up against the equity in their home to cover the latest most the job.

Money is queen with regards to renovations – 78% of plans during the census questionnaire period had been mostly paid for that have dollars, according to 2021 American Property Questionnaire. But few homeowners has a-deep really to draw regarding, thus investment choices usually transform while the projects get more pricey.

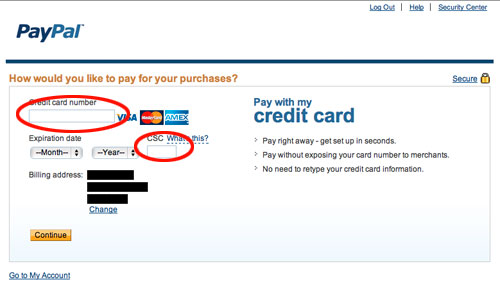

Helpful resident idea: Weigh your selection of home improvement money carefully. Cash will cost you absolutely nothing when it comes to attention, it you’ll suggest using up your coupons. Other types away from credit – credit cards, household guarantee funding possibilities and private money, for example – all the feature desire, charge and you can varying benefits words. Ideally, you’ve stored in the future and certainly will money assembling your shed outright. However if that isn’t the case, favor the financing alternative shortly after provided the can cost you and advantages.

What to anticipate: Upcoming strategies

Quite a few of (95%) people are thinking about taking on home improvement projects next couple of years, depending on the NerdWallet survey. And while many are planning small ideas – 42% are thinking about painting an area and you will twenty-five% upgrading lighting fixtures – approximately half (51%) state they’re offered renovating otherwise adding an area. Almost one fourth (22%) are thinking about ree percentage (22%) are considering remodeling otherwise incorporating a bathroom.

When expected why these are generally considering taking up this type of programs, merely one in 5 (20%) of them provided trying out home improvement systems next 2 yrs state its making their property more desirable so you’re able to audience. At the same time, 54% say it’s and make their residence easier for them and you may their loved ones, 52% state its to feel more satisfied with their home and you may 33% say it’s because their house need status is secure or useful.

Having inspiration to their home improvement projects, 40% off home owners state they https://cashadvancecompass.com/payday-loans-nd/ look so you’re able to on the internet content, more all other supply.

Costs and you may economic considerations

Residents allowed they’re going to invest $7,746 to your domestic repair and upgrade programs along side next two decades, on average, with nearly one fourth (24%) expecting to invest $10,000 or even more, with respect to the NerdWallet questionnaire. Which is up off good $six,251 mediocre anticipated spend as soon as we questioned for the 2020.

However, given the present state of your own discount, they know there’ll be what things to take on, things which will impression their ability to pay to your projects or have them done. When questioned what issues will have a job in their choice in the event that whenever to-do projects on coming couple of years, 44% off home owners mention rising prices, 38% the capability to pick offers, 30% the ability to see a specialist to-do work, 30% the fresh housing market and you can twenty-seven% even if we are during the a recession.