How much Security You’ve got of your house

One of several key one thing loan providers commonly view is when far security you have leftover of your home. You usually you would like to fifteen% so you can 20% security of your house so you can qualify for an alternate HELOC. Which assurances you’ve got adequate worthy of in your home in order to use against.

Your credit score

Loan providers often look at the credit score observe exactly how legitimate you are which have borrowing from the bank. To own an effective HELOC, you generally need a credit history of at least 600, many lenders may want a high rating. Which have a top score also can imply down rates of interest, that save a little money over the years.

Loan-to-Worth (LTV) Proportion

Lenders make use of this ratio to choose how much cash of one’s residence’s worth you can acquire. They usually limit the amount you could potentially acquire to guard facing markets falls that could leave you owing more your house is definitely worth.

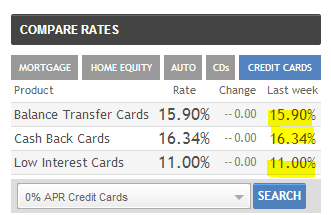

Interest rates

HELOCs often have straight instant same day payday loans online Virginia down rates than signature loans otherwise credit notes, however they can also be loosen up more than very long. Meaning you might pay so much more need for overall by the prevent of mortgage.

Controlling Money

And have now use of extra cash are tempting, we need to thought whether you could potentially deal with paying back multiple HELOCs. Way more obligations could affect debt goals, so it’s important to very carefully contemplate whether or not it can assist you can your expectations or create more difficult to achieve them.

Masters of experiencing A few HELOC Finance

- More cash Readily available: That have a couple HELOCs can provide accessibility additional money. This can be specifically of use when you yourself have large costs such as house renovations, educational costs, or scientific costs and require more cash than simply one to HELOC can provide.

- Flexibility: HELOCs allow you to borrow cash since you need it and you may pay off they your self plan from inside the draw period. And having a few function you may have a great deal more choices for handling your money. You might borrow normally otherwise as little as you prefer and just pay notice on what you use.

- Lower Interest levels: HELOCs usually have down rates than simply playing cards otherwise individual finance. This will make borrowing less. Having a couple HELOCs can provide you with much more reasonable-notice credit fuel.

- Income tax Benefits: By using the amount of money to have home improvements, the interest you only pay with the HELOCs is tax-allowable. This can help you save a fortune when tax 12 months comes as much as, that renders several HELOCs a potentially good option to have capital household ideas.

- Versatile Installment Alternatives: HELOCs tend to feature flexible fees conditions. You could choose build focus-merely costs otherwise start paying off the main. So it freedom helps you control your month-to-month funds, particularly when your income or costs changes.

Downsides of experiencing Several HELOCs

- Risk of Borrowing An excessive amount of: Having access to more money mode you are inclined to obtain more than you might manage. This can lead to economic stress for folks who not be able to remain up with repayments.

- Changing Interest levels: Usually, your own monthly premiums can go up or down once the HELOCs constantly possess adjustable rates of interest. Which have a few HELOCs, you’re met with double the latest uncertainty, so it’s more complicated to help you bundle your financial allowance in the event the rates increase.

- Risk of Losing Your property: That have several HELOCs form your home serves as equity so you’re able to one another personal lines of credit. If you can’t make repayments on often loan, you could risk losing your property to foreclosure. Consider, the greater amount of personal debt you may have, the brand new more complicated its to keep track money.

- Even more Costs and Will cost you: Taking right out numerous HELOCs results in you are spending additional charge for example assessment charge, software fees, and you may yearly fees. Such costs adds up quick and consume on professionals of experiencing numerous HELOCs.