Just like the application is complete and files recorded, the process is today out of the borrower’s give. All the documentation recorded and you may finalized up until this point is recorded and you can explain to you an automatic underwriting program to get acknowledged.

Some data would be sent to an underwriter to own guide approval. The borrowed funds manager after that gets the appraisal, demands insurance policies pointers, dates an ending, and you may sends the borrowed funds document into processor chip. Brand new processor chip could possibly get demand considerably more details, if necessary, to have reviewing the borrowed funds approval.

Specific home loan borrowers could well be entitled to installment loans online in South Carolina authorities-recognized fund, such as those insured by the Government Construction Government (FHA) or even the U.S. Service of Veteran Affairs (VA). These fund are thought non-old-fashioned and therefore are organized in a manner that makes it easier for eligible individuals pick homes. They often times feature straight down qualifying rates and you will a smaller if any deposit, plus the origination processes can be a little much easier because of this.

Illustration of Origination

What if a buyers would like to pick the first family. They set up a deal on the a home and supplier accepts. The two people indication an agreement and commit to a purchase cost of $200,000. The buyer possess a total of $50,000 saved up, meaning that they should use $150,000 to cover left equilibrium.

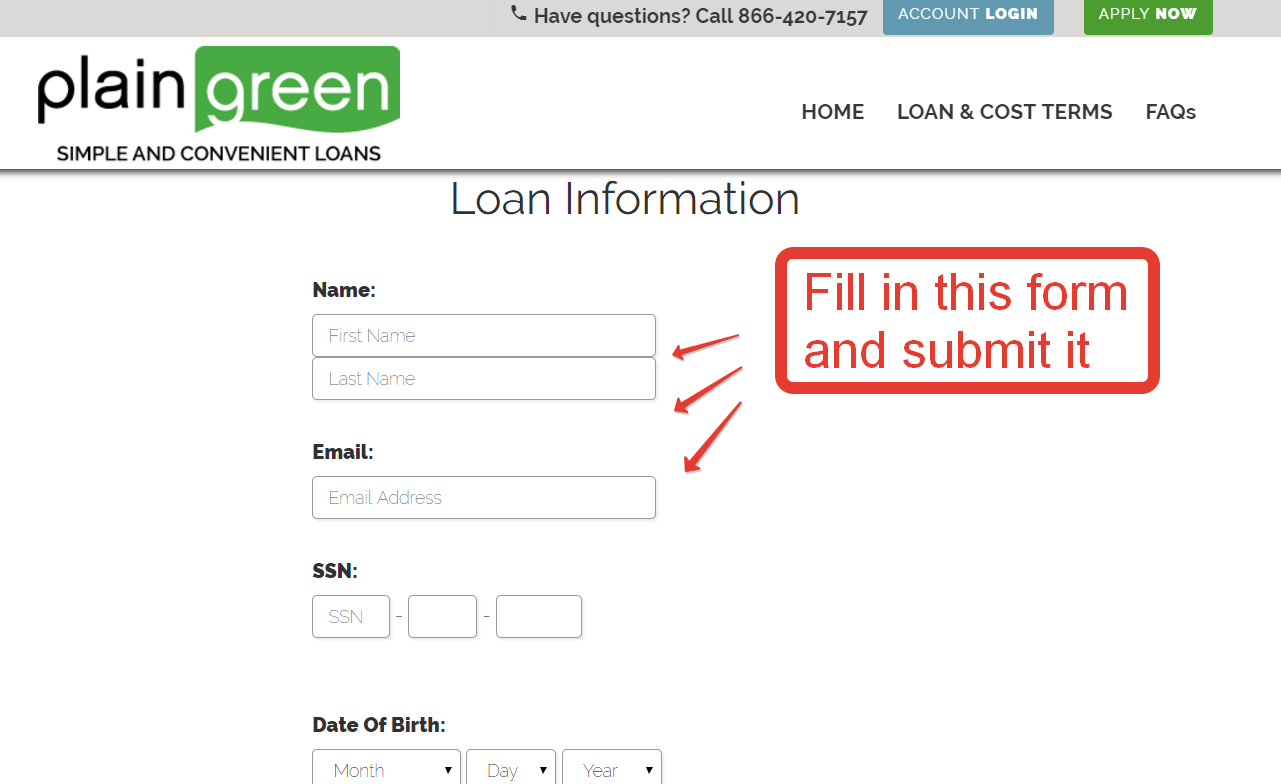

The customer visits the financial, ABC Lender, to find out if it pre-qualify. When they carry out, ABC Lender requires them to fill out an official application and you may present help files, in addition to the proof of income, tax returns, financial statements, and you may acceptance getting a credit score assessment. The applying and you will data was delivered to the latest underwriting agencies out-of ABC Lender to assess if the borrower was an appropriate applicant on financial.

Immediately following monthly, the financial institution approves the loan, associations the new borrower, and you may organizes a time for you indication the latest paperwork. The fresh new borrower was informed of rate of interest and you can loan terms and conditions and have believes to invest the loan origination payment of 1% or $step 1,500. This will either be deducted throughout the financing balance (inducing the disbursement off $148,500), pay it upfront, otherwise have the vendor spend it in their mind.

Why does financing Origination Really works?

Mortgage origination is the method loan providers used to determine and you will agree debtor applications for different different debt. They’re finance and you may mortgages. Originations move from the first application to have borrowing due to underwriting and you can the recognition process. To ensure that the procedure working, borrowers need to submit an application and additional paperwork, eg tax returns and you will spend stubs. Loan providers usually ask you for, that’s a small percentage of your equilibrium, to compensate all of them with the functions in examining and giving the applying.

Most banking companies, creditors, and lenders charge a keen origination payment your variety of financing just like the a type of settlement on the mortgage process. Including signature loans, debt consolidation funds, mortgages, domestic equity money, although some. Costs essentially vary from 0.5% to one% of your own loan equilibrium, so if you’re requesting a $100,000 loan, a 1% fee would-be $step 1,000. Specific lenders are willing to discuss the cost, which will be deducted throughout the financing disbursement or paid off upfront. Understand that you only pay the price if you’re recognized.

The applying and you may approval techniques having a charge card isn’t as comprehensive since it is for a loan. In most cases, the fresh origination off a charge card pertains to filling out an application and obtaining a credit check over, and you can getting recognized within just several weeks for some weeks. Lenders cannot charges a keen origination fee to have playing cards however they might need a protection put should you be simply setting up their credit otherwise who’s got a bad credit rating.