Homeownership during the Pennsylvania not only brings a spot to telephone call household however, even offers the opportunity to make security. When you’re a resident seeking power this new equity you centered, Household Guarantee Fund (He Financing) and you will Family Guarantee Credit lines (HELOCs) are strong economic equipment to consider. Contained in this book, we’re going to speak about the new ins and outs of The custom loans Valmont CO guy Funds and HELOCs, providing knowledge to possess Pennsylvania people drawn to unlocking the benefits into the their homes.

Information Family Equity

Household equity is actually good homeowner’s demand for their property, symbolizing the difference between brand new home’s market value together with outstanding financial harmony. For the Pennsylvania, where assets opinions may go through activity, expertise and leveraging so it equity is vital to and also make advised monetary conclusion.

In terms of accessing house collateral, a couple no. 1 options are Home Collateral Funds (He Funds) and House Collateral Credit lines (HELOCs). He Finance render a lump sum count which have a fixed attention price, leading them to ideal for organized expenditures eg house renovations. Simultaneously, HELOCs offer an effective rotating credit line, offering independence having lingering demands instance degree expenses otherwise unexpected costs. Pennsylvania home owners is always to cautiously thought their financial desires before you choose anywhere between these types of alternatives.

Eligibility Conditions having He Finance and you can HELOCs into the Pennsylvania

In order to qualify for The guy Fund or HELOCs in Pennsylvania residents typically you want a strong credit score, a fair loans-to-income proportion, and you will enough guarantee inside their residential property. Local loan providers, like those with the Morty’s program, provide personalized pointers centered on individual financial products while the book areas of new Pennsylvania market.

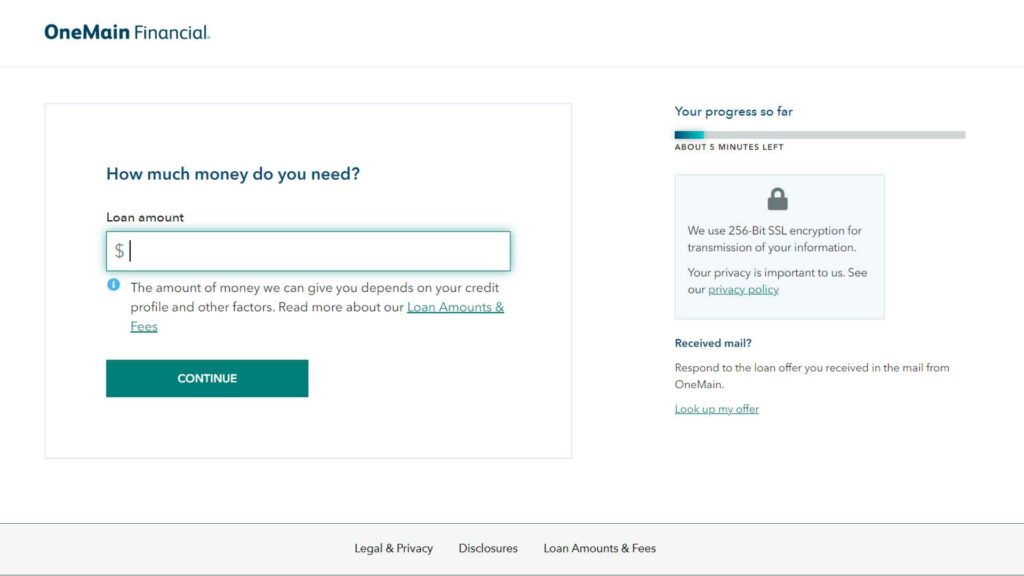

How to Make an application for The guy Loans and you can HELOCs

The application process to possess He Funds and you may HELOCs involves get together documentation, such as for instance proof income and possessions valuation. Pennsylvania people will benefit regarding handling regional financing officials which see the nuances of your own country’s market. Morty, an online home loan broker, connects consumers having local mortgage officials, making sure a personalized and effective software process. With Morty, home owners could even experience a quick closure, on the potential to close toward a HELOC when you look at the as little due to the fact two weeks.

Deciding Mortgage Amounts and you may Interest rates

The loan quantity and you will rates of interest for The guy Finance and you may HELOCs trust various factors, including the amount of guarantee, creditworthiness, and you can markets requirements. Pennsylvania home owners can benefit on aggressive prices supplied by local loan providers, specially when using online platforms eg Morty that streamline the credit techniques.

Popular Uses for He Money and you can HELOCs

Pennsylvania residents tend to make use of He Finance or HELOCs having a variety off motives. Regarding financial support home improvements to help you merging high-notice obligations otherwise level training expenses, such monetary systems provide the independency must get to certain monetary goals.

Factors

While he Financing and you may HELOCs offer extreme professionals, its critical for home owners to be familiar with perils. In control play with is vital, and knowing the words, potential changes in rates of interest, and the risk of foreclosures if there is payment default are crucial. Regional loan officers, available courtesy Morty, also provide recommendations on in control borrowing.

Unlocking house equity through He Fund or HELOCs for the Pennsylvania demands consideration and you can informed decision-to make. Because of the knowing the differences when considering these types of choice, seeing regional mortgage officials, and making use of on the internet platforms such as for example Morty, homeowners can leverage their collateral to achieve the financial requires responsibly. Think of, an important will be to make this type of economic systems along with your novel circumstances and fantasies.

If you’d like to feel introduced to a local loan manager near you, do an account into the Morty now! Zero pressure, free, just high regional possibilities and you can assistance!