Once twenty years off renting for the Boston and soon after Spokane, Florence Mwangi felt like it was time to try and get their particular first household.

The newest 56-year-dated custodian, who concerned the usa regarding Kenya, chose exactly what of several believe is a perfect date: rates was basically therefore low so it renders more pricey home reasonable. However, those same pushes possess led partially to a very lower matter away from property on the market, that’s riding new average price of Spokane house so you can historic levels.

Her realtor found a property to own Mwangi inside northwest Spokane. But not, the initial two financial institutions she tried sometimes desired too much money since the a down payment or turned their off.

The fresh new marketing remains in the act. We haven’t finalized yet ,, Mwangi said. I can’t hold off to view new family. I’m most delighted.

It is absolutely supposed in love, said Jack Heath, president and chief performing officer from Washington Believe Bank from inside the Spokane. We are having number weeks every month for both brand new home orders and you will refinances from current purchases.

Although the fresh new pandemic has actually ravaged the resort, cafe and you will traveling industries, the lower interest rates to own financing features encouraged many homeowners in order to pounce into apparently cheap money. Finance companies instance Numerica Borrowing from the bank Commitment is actually processing an archive quantity of financing.

Troy Clute, an elder vice president in the Spokane Valley-created Numerica, told you his team processed on the 62% family purchases from inside the 2019, as compared to 38% within the refinanced funds. However in 2020, Numerica has actually canned 36% to possess instructions of brand new house and you may 64% getting refinancing established mortgage loans.

That doesn’t mean the newest sales has fell of, Clute said. He could be at the same height. But, as a share out-of company, he’s dropped. Last year due to July, we performed on the $forty million in the (refinanced finance). This year through July, we’re within $119 billion.

Ezra Eckhardt, Ceo of STCU, told you their institution has been experiencing the same hurry of people taking advantage of the low rates of interest.

Just last year we’d accurate documentation design season for all of us, Eckhardt said. We are going to go beyond that this year by the end off August.

A loan officer titled their own back into four hours

This new consult has actually outstripped the number of residential property upcoming on the field. Eckhardt together with believes your number of individuals moving to Spokane and you may Northern Idaho from in other places has already established a remarkable impact on home values.

A portion of the reasoning the fresh homes age number of house begins and not as much inventory, he told https://clickcashadvance.com/payday-loans-il/san-jose you. The next thing is that after five days in the an effective pandemic, you will find had a call at-is born other places.

I have heard anecdotally that individuals need certainly to promote into the Seattle and you may move to Spokane, the guy proceeded. They don’t want to wreak havoc on the brand new protests and downtown. It’s better to bypass here.

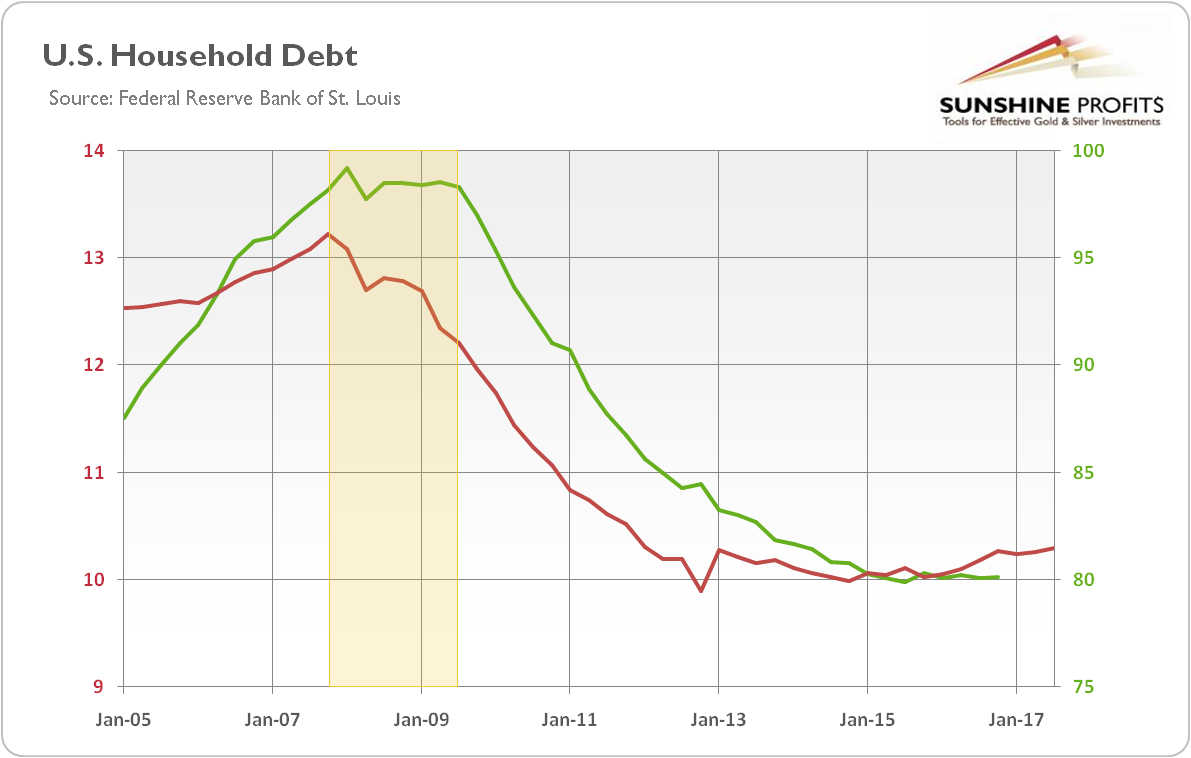

Yet not, the forces with motivated our home market can quickly change if for example the business losses regarding the pandemic establish a corresponding count from home foreclosures, the guy said.

Certain homeowners are refinancing to lower the monthly financial costs, other people are taking out fully household-collateral personal lines of credit so you can inform their established residential property, and some is actually converting important 31-year mortgage loans so you can fifteen-12 months otherwise 10-12 months mortgage loans, paying the personal debt eventually, numerous lenders said

There is a lot regarding suspicion towards just what will occurs for the long-title home loan forbearance and you may rent abatements, the guy told you. I’m hopeful you to definitely federal and state governing bodies manage to offer the modern applications. When we begin moving those individuals as much as, it could be disruptive for the housing industry.

As the also provide side could possibly get transform, the lower rates is always to are nevertheless for a long period, the guy said. The mortgage rates depend on the fresh new financing speed so you’re able to banks which is set because of the Federal Put aside.

He or she is projecting checklist-low interest rates for at least 2 years into the future, Eckhardt told you. I am unable to think them increasing notably next a couple of years.

Heath, out of Washington Faith, said in the modern state, having less readily available belongings provides brought about rates so you can plunge and you can caused most other residents to make option arrangements.

Discover instance a lack of collection that i could possibly get listing a property to possess $three hundred,000 and finish promoting they having $315,000 or $320,000 on account of bidding battles, Heath said. Nevertheless are providing at the a top point in the market industry. Then you’ve to show around and purchase. That sort of produces the situation.

Folks are stating, Take, let us sit where the audience is during the,’ he said. Let’s remove some funds aside. We shall redesign this place and we will simply remain put.

Borrowers generally can be all the way down their monthly installments if they get rid of their interest cost from the refinancing their existing financial. Although not, when they decide to extract currency according to research by the improved worth of their residence, otherwise collateral, banking institutions generally only make it homeowners so you’re able to re-finance 80% of your own value of their home and can charge a top interest rate.

The stock exchange continues to manage most very well. It is a strange time, the guy told you. We are seeking figure it out what is the impact that can provide a recession into enjoy?’

Generally, our company is behind new curve off impact the pain sensation and you can repairing throughout the discomfort, Heath told you off recessions and you may Spokane. If your discount continues to sustain enough time-term and you may employment really actually starts to always drop off … up coming we will understand the housing industry endure. However,, do not see anything on near identity that will adversely apply to which.

Promote to Brand new Spokesman-Review’s Northwest Verses forums show — that helps to help you counterbalance the can cost you of numerous reporter and you may publisher positions on magazine — by using the easy solutions below. Presents canned contained in this system are not tax-deductible, but are mainly used to help meet the regional monetary criteria must located national matching-offer financing.