Having choice foreign exchange account sorts to pick from offers buyers an environment for finding that matches perfectly and matches their wants. Choosing the international trade account sort for you includes careful attention to numerous components, what your have to be, your tolerance for danger, the quantity you make investments, and your trading method. Forex trading, also referred to as overseas exchange or FX trading, involves the buying and promoting of currency pairs, corresponding to USD/INR or EUR/INR, to profit from change fee types of broker fluctuations. As with any service, issues can go incorrect – it’s a platform outage, a pricing error, an incorrect account assertion, or another technical problem. No broker is proof against this, but as a dealer, it is necessary to know that the broker is reachable and that they will be accountable, and act shortly to resolve issues and in a good technique.

Forbes Releases ‘the World’s Best Banks 2019’, Ten Indian Banks In

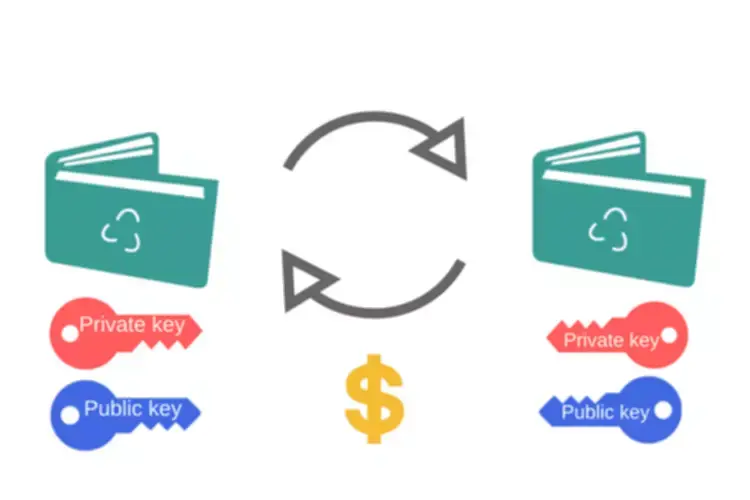

Retail merchants are individual buyers who put money into forex in their private capacities. Retail traders open a foreign forex trading account with stockbrokers and buy and sell forex pairs using their cash. If you are new to foreign currency trading and want to discover the foreign exchange marketplace with out clearly spending your cash, a Demo account is what you want. Many on the forex market misconceive that demo accounts are satisfactorily applicable for newbies’ handiest. At the same time as the truth is, demo cash owed can be useful even to those who have large experience overseas trade buying and selling. One of the components of demo money owed is that they’re an ideal device for exploring and experimenting with new forex brokers, structures, and methods.

Is Cross Forex Buying And Selling Allowed In India?

An option buyer’s risk is proscribed to the price of purchasing the choice, often known as the ‘premium.’ The revenue potential of an choice buyer is theoretically countless. For an choice vendor, however, the chance is potentially endless, but the revenue is restricted to the premium obtained. Put Option – A put option allows the holder the proper, but not the duty, to sell the chosen foreign money at a predetermined price until the expiration date. An FX choice – which could be a call or a put, is used to set an change fee for a future transaction in order to shield towards unfavourable currency actions. Additionally, the supply of automated trading options via algorithms can streamline processes, executing trades primarily based on predetermined criteria with out handbook intervention.

What Are The Gaps In Forex Trading?

- Consider components similar to trading platforms, account varieties, customer help, and the provision of instructional sources.

- There are 5 types of foreign money markets in India – spot, ahead, futures, options and swaps.

- Some frequent forex trading orders include market orders, cease orders, and restrict orders.

The user interface ought to be intuitive, permitting even novices to use it easily. Before committing, strive the platform via a demo account to test its performance and reliability. Currencies are at all times traded in pairs, so the “value” of one of many currencies in that pair is relative to the value of the other.

Begin Small And Gradually Enhance Positions

Today, we persist in inquiring about ourselves to deliver merchants what they require to flourish. Forex buying and selling is an around-the-clock course of, with numerous buying and selling sessions in numerous time zones overlapping with one another. It helps foreign exchange merchants to trade at their own comfort and find quite a few coaching opportunities. One can actively commerce 4 prominent forex pairs in Forex, specifically USD/CHF, EUR/USD, GBP/USD, and USD/JPY. From social to economic and political occasions, many elements influence the currencies.

Our editors independently analysis and advocate the most effective products and services. You can study more about ourindependent evaluation processand companions in ouradvertiser disclosure. No, you can begin with a comparatively small amount of capital, nevertheless it’s important to manage danger rigorously.

Additionally, the ability to leverage positions signifies that traders can management a a lot bigger place even with a small initial capital, amplifying potential earnings. In Forex trading, understanding the forces that drive foreign money values is paramount. Exchange rates, one of many crucial components of this vast monetary market, are influenced by many intertwined factors. TradeFxP is considered one of the Global Market Leaders – We’ve been proud to affix unbiased traders in the prospect of the global currency markets since 2012.

Technical evaluation includes finding out previous market information, primarily price and volume, to forecast future value movements. On the opposite hand, basic analysis evaluates the economic, monetary, and different qualitative and quantitative components that influence a currency’s value. To interact in foreign forex trading, merchants sometimes use a buying and selling platform provided by a dealer. These platforms provide tools and options for analyzing the market, executing trades, and managing risk.

Tastyfx also has restricted transparency relating to overnight interest costs, and its chat assist could be slow outdoors of business hours. The dealer is suited for each new and skilled merchants because of its well-designed platforms, huge educational content material, fast executions, zero commissions, low spreads, and nice customer support. Users can use a number of buying and selling platforms, together with cellular apps and a web-based buying and selling interface.

Learn how to execute technical evaluation and use the indications to analyse currencies and establish trading alternatives. You can also mix technical indicators with basic analysis for a better strategy. Today, banking institutions execute forex trades on behalf of their purchasers, corresponding to high-net-worth individuals and firms. When it comes to swing buying and selling, there are some widely used methods together with reversal, retracement, breakout, and breakdown buying and selling. They will offer a quote based mostly mostly on the underlying market worth, after which sit on the other facet of the client’s trade.

One such foreign money pair is the British pound/Japanese yen as proven in Figure 1, above. This pair is considered to be extraordinarily unstable, and is great for short-term traders, as common hourly ranges may be as high as a hundred pips. This fact overshadows the 10- to 20-pip ranges in slower shifting foreign money pairs just like the euro/U.S. It can additionally be price noting that some giant inventory brokers supply access to limited foreign foreign money trading. Interactive Brokers stands out as a uncommon buying and selling platform that does forex and a variety of asset lessons equally well.

Read more about https://www.xcritical.in/ here.